MAS greenlights bid by Gordon Tang’s Acrophyte to acquire Suntec Reit manager for S$190 million

Therese Soh - The property tycoon made a failed attempt to acquire all units of the real estate investment trust in 2024

Intraco’s major supplier declares force majeure over Iran conflict

Janice Lim - The Middle East situation has disrupted the supply of olefins used to make plastics, fibres and detergents

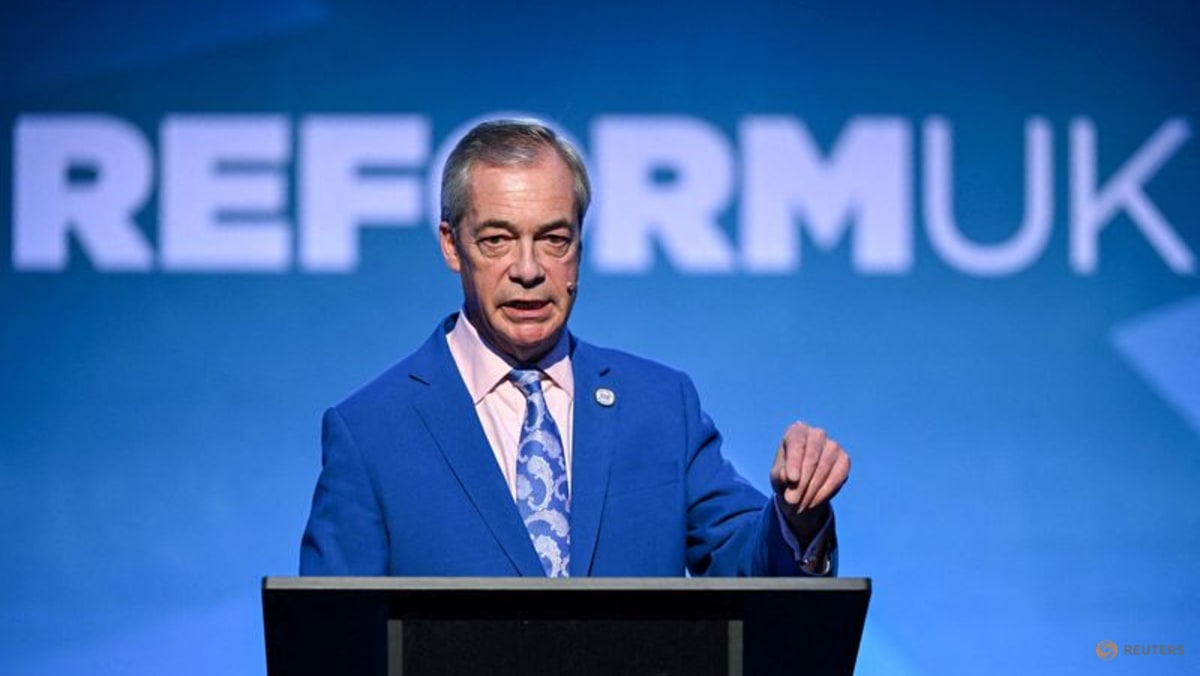

Reform UK's Nigel Farage invests in bitcoin-buying company

LONDON, March 9 : Nigel Farage, leader of the populist Reform UK party, has invested in Stack BTC, a London-based company aimed at acquiring small British companies and investing surplus capital into bitcoin, a statement said on Monday. Farage, a public supporter of bitcoin who has secured big donat ...

Acquisition of Suntec REIT's manager given go-ahead by MAS

The Edge Singapore - ESR Trust Management, manager of Suntec REIT, says that its acquisition by Acrophyte Asset Management has been given the green light by the Monetary Authority of Singapore. The acquisition of the manager was first tabled last December, which follows a mandatory conditional offer of $1.16 per unit in ...

Trump bought Netflix and Warner Bros bonds at height of bidding war with Paramount

WASHINGTON, March 9 : U.S. President Donald Trump bought more than $1.1 million of Netflix bonds over the last three months as the streaming giant unsuccessfully fought Paramount Skydance to buy Warner Bros Discovery, according to government disclosures.Trump bought more than $500,000 of Netflix� ...

Serial Achieva in talks over potential deal involving its shares

The Edge Singapore - Serial Achieva, a separately listed subsidiary of Serial System, says in an announcement after market closed that it is in talks over a "potential transaction" involving its shares. Earlier in the day, the company's share price surged by 31.15% to close at 16 cents. "Shareholders ...

Amazon's Zoox to launch command hub in Arizona, expand testing to Dallas and Phoenix

March 9 : Amazon's robotaxi unit Zoox is expanding testing to Dallas and Phoenix and launching a command hub for fleet operations in Arizona, as it looks to widen its footprint in the U.S.'s increasingly competitive autonomous taxi market.The move will expand testing operations to 10 marke ...

Microsoft taps Anthropic for Copilot Cowork in push for AI agents

March 9 : Microsoft is adding Anthropic's AI technology to its Copilot service to tap growing demand for autonomous agents, weeks after the startup's new tools sparked a selloff in software stocks.The company on Monday unveiled Copilot Cowork, a tool based on Anthropic's viral Claude ...

Singapore logistics firms could face 50% cost surge as Middle East cargo stalls amid tensions

The Association of Small and Medium Enterprises said firms may be forced to make tough decisions, including cutting manpower and reducing rental costs to cope with the disruption.

DBS on track to cut financed emissions of most sectors

Janice Lim - Lender’s sustainability report discloses that 15% of management’s remuneration is tied to ESG matters

The US$100 barrel: Oil shockwaves reach South-east Asia

Elisa Valenta - They are showing up in higher transport and food costs, electricity prices, fuel prices and bigger fuel subsidy bills for governments

The $100 barrel: Oil shockwaves reach South-east Asia

Elisa Valenta - They are showing up in higher transport and food costs, electricity prices, fuel prices and bigger fuel subsidy bills for governments

Pakistan cenbank holds rate at 10.5% as oil risks cloud inflation outlook

KARACHI, March 9 : Pakistan’s central bank kept its key policy rate unchanged at 10.5 per cent on Monday, pausing its easing cycle as rising global energy prices and regional tensions pose new inflation risks for the import-dependent economy.War between Iran and the U.S. and Israel has effectively ...

Trump sons-backed Aureus to merge with drone maker Powerus

March 9 : Aureus Greenway, a golf club company backed by the sons of U.S. President Donald Trump, said on Monday it would merge with Powerus in a deal designed to take the drone technology company public.The transaction is the latest in Eric and Donald Trump Jr.'s growing investments in the dro ...

Trump brothers-backed Aureus to merge with drone maker Powerus

March 9 : Aureus Greenway Holdings, a golf club company backed by the sons of U.S. President Donald Trump, said it will merge with Powerus in a deal designed to take the drone technology company public.The transaction is the latest in Eric and Donald Trump Jr.'s growing investments in the drone ...

‘Very grim’: Singapore, regional petrochem sector could see more force majeure notices; EDB in contact with players

Sharanya Pillai - Government agencies are working to support companies amid the ‘evolving situation’

Mainland investors buy a record HK$37.2 billion in Hong Kong stocks via trading link

The unprecedented purchases are a reminder of the rapid shifts in mood among investors

ABB teams up with Nvidia to improve factory robot training

ZURICH, March 9 : ABB's robotics business has partnered with Nvidia to narrow the gap between how industrial robots perform in virtual simulations and how they behave on factory floors, the companies said on Monday.Swiss-based ABB will use Nvidia's Omniverse libraries of simulated data to ...

Sunway Healthcare sets final price for $722 million IPO, Malaysia's largest in nine years

March 9 : Malaysia's Sunway Healthcare on Monday set its final offering price at 1.45 ringgit per share, in line with its earlier prospectus, aiming to raise 2.86 billion ringgit ($722.22 million) in what could be the country's largest listing in nearly a decade.The initial public offering ...

Great Eastern names OCBC director Andrew Khoo as chairman-designate

Therese Soh - He assumes the chairmanship on Apr 15, succeeding incumbent chair Soon Tit Koon

From Shell to Singapore Airlines: the potential winners and losers as oil tops US$100

Deon Loke - Transport companies’ profit margins take a hit while developed and emerging markets in Asia-Pacific face spillovers

Malaysia unveils five-year plan to grow capital market

It will focus on raising listed companies’ long-term valuations and performances, says Securities Commission chair

Singapore blue-chips tank following sharp spike in oil prices; STI down 1.9%

Tay Peck Gek - The only counter on the benchmark index that advances is Wilmar International, which rises 1.1% to S$3.53

Russia-backed hackers breach Signal, WhatsApp accounts of officials, journalists, Netherlands warns

AMSTERDAM, March 9 : Russian-backed hackers have launched a global cyber campaign to gain access to Signal and WhatsApp accounts used by officials, military personnel and journalists, two intelligence agencies in the Netherlands warned on Monday.Users are persuaded in chats initiated by the hackers ...

Airline shares battered, airfares surge as Iran war pushes oil above $100

HONG KONG/FRANKFURT, March 9 : Airline stocks were hammered on Monday, while airfares soared as the U.S.-Israeli war with Iran sent oil prices surging, sparking fears of a deep travel slump and the potential for the widespread grounding of planes.Oil prices jumped 15 per cent to above $105 a barrel, ...

Airline shares battered, airfares surge as Iran war intensifies

HONG KONG/FRANKFURT, March 9 : Airline stocks were hammered on Monday, while airfares soared as the U.S.-Israeli war with Iran sent oil prices surging, sparking fears of a deep travel slump and the potential for the widespread grounding of planes.Oil prices were trading more than 15 per cent higher ...

New chairman at Great Eastern Holdings

The Edge Singapore - Great Eastern Holdings has appointed Andrew Khoo as its new chairman, replacing Soon Tit Koon. The changeover will take place on April 15, the day after the company holds its next AGM. Khoo, who spent 22 years with the Monetary Authority of Singapore, joined GEH's board last September. Since Ma ...

Middle East conflict could spur palm oil demand from biodiesel sector

MUMBAI/KUALA LUMPUR, March 9 : Rising crude oil prices and higher freight rates driven by the Middle East conflict could boost demand for palm oil from the biodiesel sector and for food use, as Asian buyers seek prompt shipments, industry officials told Reuters.Indonesia and Malaysia's output r ...

GIC-backed Greenko Energies weighs US$1 billion India IPO: sources

The company has held preliminary discussions with bankers for a potential share sale as soon as this year

Taiwan February exports miss expectations; caution on US trade policy

South-east Asia faces sweltering heat as war limits energy supply

A prolonged disruption will threaten the fossil-fuel-reliant region’s power generation into April and May

China’s biggest eye hospital chain Aier plans Hong Kong listing: sources

Aier trades in Shenzhen and has a market capitalisation of about 96 billion yuan

Indonesia may revive B50 biodiesel mix plan as oil prices soar

JAKARTA, March 9 : Indonesia may revive a plan to launch a mandatory B50 grade of palm oil-based biodiesel in the middle of this year because of surging crude oil prices due to the conflict in the Middle East, deputy energy minister Yuliot Tanjung said.No decision has been made yet by Indonesia, the ...

Nvidia-backed Nscale valued at $14.6 billion in fresh funding round

March 9 : Nvidia-backed artificial intelligence group Nscale was valued at $14.6 billion after raising $2 billion in its latest funding round, the British company said on Monday. The Series C funding round was led by Norway's Aker and 8090 Industries, and included Nvidia, Citadel, Dell, Jane St ...